Experts say that inflation, defined as an increase in prices over time, under the Biden-Harris Administration was the key to President-elect Donald Trump’s recent victory. The Pew Research Center reported that 93% of Trump supporters and 81% of all voters cited the U.S. economy as their top issue for the 2024 election. However, economists say that Trump voters may have voted for the very thing they were trying to avoid.

According to Nobel laureate economist Paul Krugman, Trump’s plan for the economy is “the most inflationary program, probably, that any American president has ever tried to implement.” This is because of three policies: tax cuts, tariffs and mass deportations.

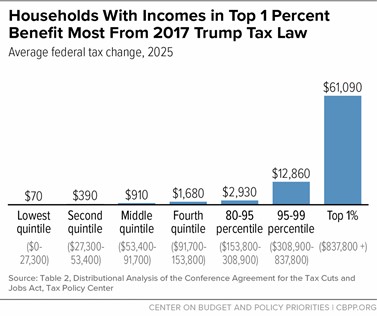

In 2017, Trump passed the Tax Cuts and Jobs Act, implementing sweeping tax cuts that the Trump administration stated would increase government revenue by $1.8 trillion over 10 years and spur a $4,000 increase in household income. According to the Center on Budget and Policy Priorities, the tax cut cost the government $1.9 trillion, did not lead to any change in household income by 2023 and benefited the top 1% more than three times as much as the bottom 60%.

Trump’s plan to make the 2017 tax cuts permanent would continue the government’s budget deficit, increasing the already $36 trillion national debt. As Paul Krugman states, “When you have an economy that’s already running pretty hot, deficits are inflationary.”

Trump’s plan to make the 2017 tax cuts permanent would continue the government’s budget deficit, increasing the already $36 trillion national debt. As Paul Krugman states, “When you have an economy that’s already running pretty hot, deficits are inflationary.”

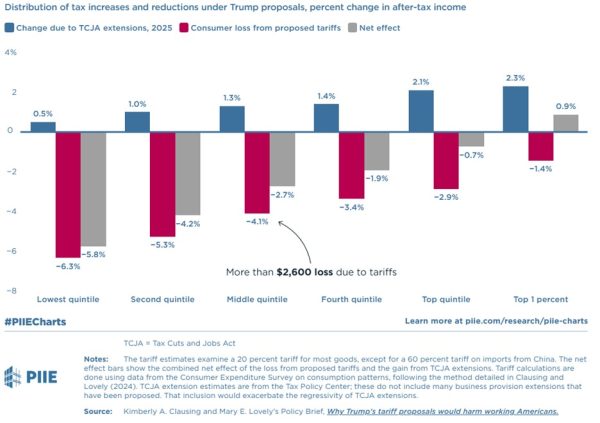

The U.S. currently has an average tariff rate of 2%, and half of all imports enter the U.S. duty-free. Trump plans to implement a 10-20% baseline tariff on all U.S. imports, as well as a 60% tariff on imports from China, calling tariffs “the most beautiful word in the dictionary.” Tariffs are taxes placed on importers, who pass the cost onto the American consumer in the form of higher prices. According to the Peterson Institute for International Economics (PIIE), the proposed tariffs would cost the average American household over $2,600 per year. Although targeted tariffs are sometimes used to protect emerging domestic industries, as Vox correspondent Eric Levitz states, “There’s no tax you can put on foreign coffee beans that will make it possible to grow them in New England.”

The hallmark policy of Trump’s 2024 campaign has been mass deportations of undocumented immigrants. Outside of the humanitarian and moral implications of this plan, it would have a significant impact on the U.S. economy as well. Mass deportations would cost taxpayers $968 billion over a decade, another $76 billion in lost tax revenue, and reduce the U.S. GDP by $1.1 trillion to $1.7 trillion. Furthermore, undocumented immigrants make up 44% of farmworkers and 20% of construction workers. Deporting workers from these key industries is very likely to drive up grocery and housing prices. The PIIE estimates that deporting 7.5 million workers would cause a 12% drop in real GDP and prices to increase by 7.4% over three years.

The hallmark policy of Trump’s 2024 campaign has been mass deportations of undocumented immigrants. Outside of the humanitarian and moral implications of this plan, it would have a significant impact on the U.S. economy as well. Mass deportations would cost taxpayers $968 billion over a decade, another $76 billion in lost tax revenue, and reduce the U.S. GDP by $1.1 trillion to $1.7 trillion. Furthermore, undocumented immigrants make up 44% of farmworkers and 20% of construction workers. Deporting workers from these key industries is very likely to drive up grocery and housing prices. The PIIE estimates that deporting 7.5 million workers would cause a 12% drop in real GDP and prices to increase by 7.4% over three years.

Krugman remarks, “It’s funny because the big run-up in prices that we had under Biden was actually nobody’s fault. It was consequences of the pandemic disruption and, to a limited extent, the war in Ukraine. And it happened everywhere… This time, if we have the inflation that I think is coming, it will be somebody’s fault. It will be Trump’s policies that do it.”

For more information:

‘People Are in for a Really Rude Shock’ on Trump’s Economy

The perils of Undocumented Construction Workers in the United States